The real crisis facing the province is not how to balance the books but how to stop rising unemployment. Yes, the deficit needs to be addressed but government’s own forecast is for a balanced budget by 2022.

RBC economists warn Newfoundlanders and Labradoreans face “grim job prospects”. “We see little to stem employment losses in the next two years as the provincial government slims down in efforts to eliminate its deficit, consumers cut back spending, and work on the giant Muskrat Falls project ends in 2019.”

The unemployment rate in Newfoundland Labrador is “officially” 14.5%, more than twice the Canadian average. The real rate – counting people who are involuntarily working part-time, waiting for jobs, or have given up looking – is more than 18%.

RECOMMENDATIONS

CUPE NL offers two recommendations to government:

1. Stimulate economic growth by investing to reduce inequality, and

2. Reduce expenditures and create efficiencies by cancelling the P3 deals

REDUCE INEQUALITY

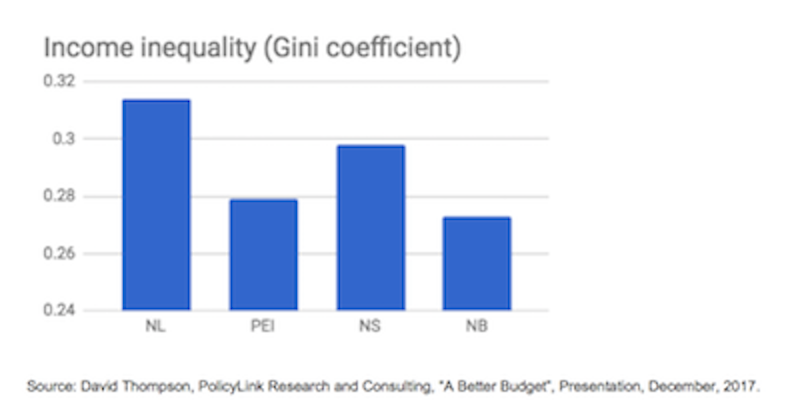

Statistics Canada reports that the gap between the highest salaries and the lowest incomes in St. John’s is the highest of the Atlantic Canadian census metropolitan areas. (See Figure 1.) The top one percent take home nearly nine times more than the bottom 30 per cent, and nearly seven times more than the bottom 50 per cent. The next largest gap is in Gander, then Halifax, followed by Bay Roberts.

Figure 1. Income Inequality Atlantic Provinces Comparison

“We definitely should be concerned about it,” says economist Tony Fang who holds the Stephen Jarislowsky Chair in Cultural and Economic Transformation at Memorial University. The incomes of the bottom 30 per cent of people across Newfoundland Labrador are around $20,000 or less a year in a province with the highest cost of living in the Atlantic region.

Fang expects the income inequality in the province to keep growing, and that it will become “a significant social issue.”

There is mounting evidence of a causal relationship between inequality and poor health. Healthcare costs have been identified by the Government of Newfoundland

Labrador as one of the province’s significant costs. Government’s focus seems to be on finding ways to cut spending but CUPE suggests investing in public services instead.

A recent study published in the Canadian Medical Association Journal (CMAJ) concluded that focusing on the social determinants of health such as income and housing can help address the root causes of disease, poor health and premature death.

Spending on social services is an effective way to improve the overall health of the population. Those with the lowest incomes (and consequently the lowest life expectancies) would benefit the most in improved health.

One way to create efficiencies in public services is to increase investments in social services like income supports and housing that will, in turn, lower health care costs.

Inequality should not only be reduced to improve social outcomes, such as good health, but also to sustain long-term growth.

The Organization for Economic Co-operation and Development (OECD) has increasingly focused on the impacts of income inequality. New OCED analysis concludes that reducing inequality boosts economic growth.

Econometric analysis by the OCED suggests that income inequality has a negative and statistically significant impact on subsequent growth. This work finds that countries where income inequality is decreasing grow faster than those with rising inequality.

The impact of inequality on growth stems from the gap between the bottom 40 percent with the rest of society, not just the poorest 10 percent. Anti-poverty programs will not be enough, says the OECD. Cash transfers and increasing access to public services, such as high-quality education, training and healthcare, are an essential social investment to create greater equality of opportunities in the long run.

To tackle inequality, the OECD suggests a focus on increasing women’s economic participation, promotion of employment and creation of good-quality jobs, investing in human capital through better skills and education policies, and, finally, redistribution through taxes and transfers.

These policies are especially important for rural communities who have borne the brunt of deindustrialization and declines in resource-extraction industries. Often public services like schools, hospitals, and long-term care facilities are the best jobs in small communities. By extension the job security and health and welfare benefits afforded to unionized employees at these public facilities, most often women, keep families and communities together and healthy. These public sector services and jobs also sustain private sector businesses.

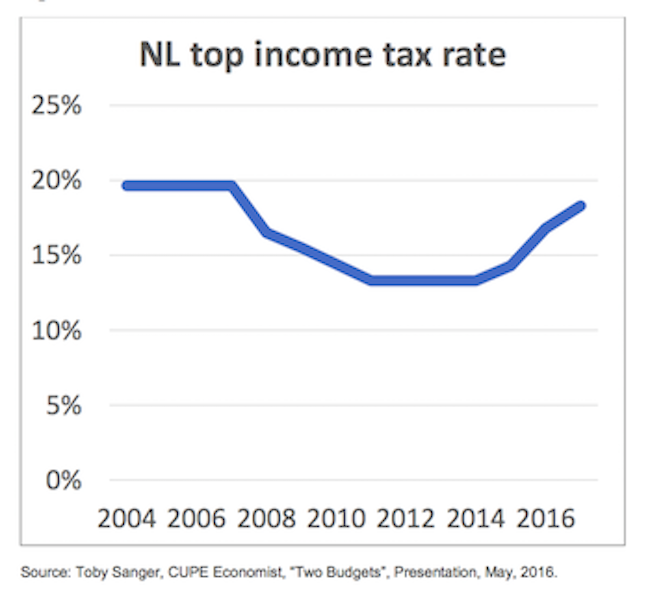

Tax policy of recent governments has contributed to increased inequality.

Newfoundland Labrador’s personal income tax system has become less progressive since 2008 because of a series of tax cuts. (See Figure 2.)

Figure 2. Income Tax Cuts – Newfoundland Labrador

The bulk of those income tax cuts went to the wealthy. Even with recent increases to personal income taxes, the rate for top incomes is still below the rates that were effective up until 2007.

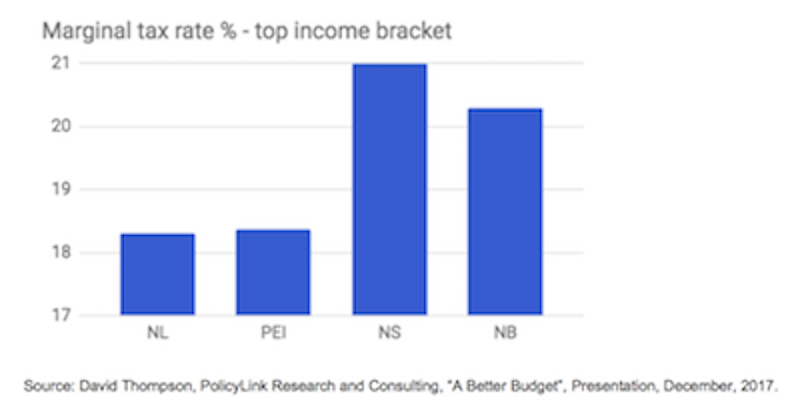

Not only is Newfoundland Labrador’s top taxation rate lower than nearby provinces, and lower than it was up until 2007, Newfoundland Labrador’s top rate only begins to apply at a much higher income level than in most other provinces. (See Figure 3.)

Figure 3. Top Income Tax Rates – Atlantic Provinces

Government can reduce inequality by making the income tax system a more progressive one.

Another way to reduce inequality is to raise the minimum wage. CUPE urges Newfoundland Labrador to follow the lead of Governments in Alberta, Ontario and B.C. and increase the minimum wage to $15 an hour.

A $15 minimum wage would significantly boost the income of low-wage workers as a group, reduce working poverty and make a dent in the large increase in income inequality. Although $15 an hour is not a living wage, it is a step in the right direction.

Increasing the minimum wage is also a stimulus to the local economy because low-income earners spend most of their income and chiefly in their community.

CANCEL THE P3 DEALS

Two recent events add to the evidence that P3s are an expensive and risky procurement model that governments and taxpayers should avoid. They should be of particular concern to this government which has announced the province’s first P3 projects, including a hospital and three long term care homes.

The first event is Ontario’s Auditor General Report released in December 2017 exposing further problems with P3s in that province. The Auditor General singled out P3 hospitals and maintenance contracts for particular attention. The Corner Brook P3 long term care home and hospital will include maintenance contracts.

The Auditor General identified five key problems with the maintenance of the 16 privatized P3 (“public private partnership”) hospitals in Ontario:

- Long-term ongoing disputes with privatized P3 contractors over the P3 agreements, including about what is covered by the P3 contract.

- Hospitals are required to pay higher than reasonable rates to the P3 contractor for maintenance work the contractor has deemed to be outside of the P3 contract. In other words, Ontario hospitals are being gouged by P3 contractors on maintenance work that is not covered in the original contract.

- Hospitals are experiencing funding shortfalls for their P3 maintenance agreements.

- Four hospitals that the Auditor General spoke to have either requested additional funding from the Ontario Ministry of Health and Long-Term Care (MOHLTC) or informed the Auditor General that they had experienced a funding shortfall but had not made a request for additional funding from the Ministry. These hospitals advised the Auditor General that the total funding shortfall was $8.1 million in 2015/16.

- The MOHLTC has provided some extra funds for the P3 hospitals to deal with these shortfalls, but, according to the hospitals the Auditor General spoke to, the additional funding provided by the Ministry does not cover the full amount of the shortfall. Management at the hospitals informed the Auditor General that they have been required to reduce funding in other areas within their existing budgets to make up these shortfalls.

- Two key benefits that hospitals expected from P3 maintenance agreements have not been realized. The two key benefits they hoped for were: [1] that the monthly P3 payments hospitals make would cover all maintenance within the scope of the P3 agreement; [2] and hospitals would transfer the risk of maintaining the hospital to the private-sector company. “However, all the hospitals we contacted informed us that, due to the way that private-sector companies have interpreted the Alternate Finance Procurement [P3] agreements, the hospitals are not realizing these benefits.”

- Hospitals informed the Auditor General that the P3 “escalating dispute resolution methods” are collectively time-consuming and ineffective at resolving disputes.

Here are examples of two disputes from the Auditor General’s Report:

- In one of the hospitals interviewed, 30 out of 84 negative pressure rooms were not in use from May 2015—when the construction of the hospital was determined to be substantially complete—to July 2017, when the private-sector company finally acknowledged and started to address the deficiency. Making these rooms available is the responsibility of the P3 contractor under the maintenance portion of the agreement. According to the CEO of the hospital, this is a serious matter because negative pressure rooms are used for infection control. The hospital CEO further noted that, even after acknowledging the availability failure, the private-sector company was still very slow to respond to and resolve the failure, causing the hospital to suggest that it appeared that the penalties were not significant enough to incentivize faster resolution. To date, the hospital has withheld $139,000, which represents two months’ worth of penalties. As of July 2017, this situation remained largely unchanged.

- In another hospital, the Personal Alarm System, which is a central monitoring system that is intended to ensure the health and safety of patients, staff and visitors, experienced repeated failures since January 2014; these persisted into 2017. Examples of the failures include false alarms, system slowdowns, security office camera problems, and door lock issues. The hospital and the private sector company are in dispute regarding the amount of penalty, in the form of deductions against payments to the private-sector company. The hospital has asserted that the amount of deductions allowed under the AFP agreement totals over $71.4 million over the three-year period, but the private-sector company has not recognized any failures. In addition, the hospital has incurred over $2.3 million in legal, consulting and other professional fees since January 2014 to deal with this issue.

Despite problems such as this, the Auditor General found that P3 companies with poor performance records were still winning contracts – one such company got in on a P3 deal worth $1.3 billion in 2016 and another worth $685 million in 2017. There seemed to be an absolute disconnect between the arm of government awarding the P3 contracts, Infrastructure Ontario, and the Ministries of government managing disputes with the private-sector companies during the maintenance phase of existing P3 projects. As a result, private-sector companies in the consortia that have performed poorly in maintaining buildings—in that they have had many failures and disputes with hospitals and other government entities—have been members of other consortia that have been awarded additional P3 contracts.

This Auditor General report deals with only one (small) aspect of the P3 deals – maintenance. Earlier AG reports have shown major problems with other aspects of the P3 model of procurement.

The second recent P3 development is the collapse of Carillion, a global promoter of public-private partnerships. Carillion sponsored and financed more than 60 P3s as well as holding contracts for facilities management services. In the UK alone, Carillion held contracts to provide food and cleaning services to schools, maintenance and facility management services to hospitals, services in prisons and military bases, among others.

Carillion is involved in 10 P3s across Canada, primarily in Ontario, Saskatchewan and the Northwest Territories. Two hospitals are still in development.

The Government of Newfoundland Labrador relied heavily on the Saskatchewan experience to design and promote its P3 procurement projects. With the Carillion bankruptcy, Saskatchewan may be left with unanticipated 30-year contract obligations for the construction and maintenance of the new North Battleford P3 hospital in which Carillion was a consortium partner. The North Battleford hospital has already been criticized for its costly maintenance contract which was higher than the maintenance budget for the entire former health region.

A second cautionary tale from the Carillion collapse is the role that large accountancy companies such as KPMG, EY, Deloitte, PricewaterhouseCoopers play in the P3 business. In Britain, KPMG is under investigation by the Financial Reporting Council (FRC) for potential breach of the ethical and technical standards for auditors as the House of Commons attempts to grapple with Carillion’s massive debts and pension deficits. There are calls for scrutiny of all of the accountancy firms who have become deeply embedded in the lucrative P3 promotion and revenue streams.

All the large accounting firms that advise governments on P3 proposals – KPMG, Deloitte, EY and PricewaterhouseCoopers – are sponsoring members of the Canadian Council for Public Private Partnerships, the leading lobbying organization for the P3 industry with an explicit mandate to promote and facilitate public-private partnerships.

The Government of Newfoundland Labrador has for all intents and purposes hired EY to manage its P3 contracts. The consultants and accounting firms that prepare the business cases and assessments for the P3 agencies generate considerable income from P3s. How is it possible for EY to provide an independent and impartial assessment of P3 proposals when its ties to the P3 industry run so deep?

CONCLUSION

Higher unemployment and growing inequality threaten the future of Newfoundland Labrador as do P3s which transfer huge costs and risks to future generations.

CUPE NL urges government to make these issues its budget priority.

Download a printable copy of the submission (with sources).